Market developments:

- Carbon falls to €7.39, down 6%

- Clean dark spreads recoup previous week’s losses

- EU politicians finally find agreement on Phase IV reforms

- EU Commission unlikely to support UK government plan to bring forward 2018 UK compliance dates

- Worried about EU ETS Brexit risk? Contact us to join our confidential EU ETSinstallations-only working group

EU Allowance Auction Overview:

- Auction volume falls to ~18.4Mt this week, down from ~23.2Mt

- ~90.4Mt EUAs set to come to market in November before December auction volumes fall to ~53.5Mt

- See auction table below for details

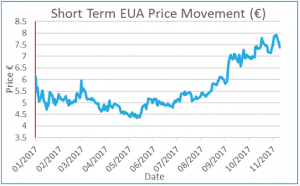

EUA PRICE ACTION

EU politicians finally found agreement on the Phase IV reforms last week – the most significant element being the MSR provisions designed to boost price – and the EUA price responded by falling more than 6% to €7.39! We had warned the previous week of speculators ‘buying the rumour, selling the fact’ and so it transpired. The fall in EUA prices is not a reflection of the Phase IV reforms which are bullish for EUA prices in the long term. Rather, the impact of the agreement is limited in the short-term and the speculative optimism in the run up to the trilogue  negotiation quickly washed out following the agreement. You can read more about the details of the Phase IV reform package below in the ‘Other News’ section. Carbon began the week by continuing the previous week’s gains with Monday closing higher and the high of the week (€8.02) trading on Tuesday. However, the failure to hold ground above €8 coupled with several low-priced auctions turned the market focus lower. Prices tumbled from Tuesday afternoon with each closing price lower than the previous. Price Impact: the large fall in carbon prices again moved against the fundamental signals as gas prices rose and the clean dark spreads regained previously lost ground. Ordinarily both these factors would be bullish. This strengthens our view that price moves over the last two-weeks have been largely speculator led.

negotiation quickly washed out following the agreement. You can read more about the details of the Phase IV reform package below in the ‘Other News’ section. Carbon began the week by continuing the previous week’s gains with Monday closing higher and the high of the week (€8.02) trading on Tuesday. However, the failure to hold ground above €8 coupled with several low-priced auctions turned the market focus lower. Prices tumbled from Tuesday afternoon with each closing price lower than the previous. Price Impact: the large fall in carbon prices again moved against the fundamental signals as gas prices rose and the clean dark spreads regained previously lost ground. Ordinarily both these factors would be bullish. This strengthens our view that price moves over the last two-weeks have been largely speculator led.

WEEK AHEAD

Based on moves over the last few weeks having been speculator led, the focus now comes back to the underlying demand in the market i.e. on-going compliance buying. It is likely that speculators are trading short and they will have to buy back at some point, likely targeting the previous low around €7.09. If speculative buy-back and underlying demand doesn’t overcome auction volumes then the price could be in for a sharp downward correction, in particular as speculators ‘reload’ their short positions. However, the last 6 months have seen prices move higher in a robust upward trend. It is too early to determine that this trend is broken. Underlying demand could continue to outstrip supply and prices will likely continue to rise. One less auction this week makes that outcome more likely. Nonetheless, we maintain our bearish view for the coming week due to the absence of obvious bullish influences on the horizon. As is becoming customary, and even more appropriately as we enter the winter months, we are keeping a watchful eye on power, coal and gas price developments.

OTHER NEWS

BREXIT UPDATE: EU Commission unsupportive of UK government plan to bring forward 2018 compliance dates

Information obtained by Redshaw Advisors suggests the EU Commission is unlikely to deem the UK government plan to bring forward the 2018 compliance date for UK installations as sufficient to avoid an invalidation of UK issued allowances from 1st January, 2018. The lack of EU Commission support comes despite some positive signals from some Member States, most notably Germany. The proposed amendment to the registry regulation would see UK issued allowances marked with a country code, invalidating their use for compliance should it be deemed ‘necessary’ to protect the environmental integrity of the EU ETS.

The UK government proposal to bring forward the compliance date for all installations gained little traction in Brussels so an alternative plan to use national law to bring forward the compliance dates for UK installations only is an effort to avoid the ‘where necessary’ nature of the regulation change. See last week’s weekly for more details.

Redshaw Advisors have created a BREXIT IMPACTS discussion group that all EU ETS installations should join. We will provide regular Brexit updates as well as engage in Q&A discussion of the specific concerns of installations covered by the EU ETS. To encourage debate, participation in the discussion group will be anonymous and is reserved for EU ETS installations only. Join the group here.

Redshaw Advisors have produced a brief guide to the potential impacts of Amendment 47 here.

EU politicians finally find agreement on Phase IV reforms after marathon trilogue negotiation

Agreement on the Phase IV reform package was finally reached in the early hours of Thursday morning after another marathon trilogue session that finished after 3:00 a.m. CET. The reform package sets out the rules that will govern the EU ETS from 2021 until 2030 and will have wide-ranging impacts for all EU ETS installations. To read more about the reforms with the biggest impact on installations and the market (the Market Stability Reserve (MSR)), please click here.

To discuss your increasing long-term exposure to the EU ETS please give the Redshaw Advisors team a call on +44 203 637 1055.