Market developments:

- Carbon closes the week flat at €7.17 having spent time in both positive and negative territory

- Gas market developments lead carbon higher in the first half of the week, however…

- Prices briefly tumble below €7 for the first time since 10th October in the second half

- Clean dark spreads improve and looming auction shutdown ensures speculative short close-out

- EU parliament extends EU ETS exemption for non-EU flights

EU Allowance Auction Overview:

- One final 2017 auction takes place on Monday

- Auctions resume on Monday 8th January, 2018

- See auction timetable below

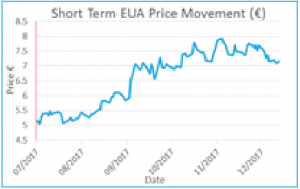

EUA PRICE ACTION

Carbon ended the week flat, ahead of the auction hiatus, having spent time in both positive and negative territory. The inability of carbon to continue last week’s falls would suggest that, for now, prices will stabilise above €7 as we go into an auction-free period ahead of the Christmas holidays and New Year. The main price action for the week was sparked by events in gas markets on Tuesday as carbon became a passenger to bullish external developments. Carbon prices moved higher in sympathy with wider energy markets as an explosion at an Austrian gas hub and additional pipeline issues caused disruption to supply and led prompt gas

Carbon ended the week flat, ahead of the auction hiatus, having spent time in both positive and negative territory. The inability of carbon to continue last week’s falls would suggest that, for now, prices will stabilise above €7 as we go into an auction-free period ahead of the Christmas holidays and New Year. The main price action for the week was sparked by events in gas markets on Tuesday as carbon became a passenger to bullish external developments. Carbon prices moved higher in sympathy with wider energy markets as an explosion at an Austrian gas hub and additional pipeline issues caused disruption to supply and led prompt gas  prices to their highest levels in several years. However, once the market digested the news, carbon prices quickly fell away from the high at €7.46 to end the day in negative territory at €7.14. Further falls led carbon to the low of the week at €6.94 on Thursday. Friday looked set to continue the decline, however, a strong German auction reversed the declines. Carbon found strong support below €7 as speculators closed out short positions ahead of the auction shutdown and a few industrial buyers emerged, keen to take advantage of lower prices before the yearend. Elsewhere the clean dark spreads made small gains as power prices outstripped coal gains but the spreads remain some way off recent highs. Price Impact: we had maintained our neutral stance last week as the mixed effects of the weather, EUA options expiry, upcoming December 17 expiry and the looming auction shutdown played out.

prices to their highest levels in several years. However, once the market digested the news, carbon prices quickly fell away from the high at €7.46 to end the day in negative territory at €7.14. Further falls led carbon to the low of the week at €6.94 on Thursday. Friday looked set to continue the decline, however, a strong German auction reversed the declines. Carbon found strong support below €7 as speculators closed out short positions ahead of the auction shutdown and a few industrial buyers emerged, keen to take advantage of lower prices before the yearend. Elsewhere the clean dark spreads made small gains as power prices outstripped coal gains but the spreads remain some way off recent highs. Price Impact: we had maintained our neutral stance last week as the mixed effects of the weather, EUA options expiry, upcoming December 17 expiry and the looming auction shutdown played out.

WEEK AHEAD

Monday sees the last of the 2017 auctions as the UK hosts the final sale of the year. It also sees the expiry of the bellwether December 17 contract that is the centre of most speculative and utility trading activity. The lack of auctions over the remainder of 2017 would appear to skew the risk to the upside and market participants will be mindful of the material increases we saw last December. But speculators may well have gone long in anticipation of this. Certainly the major utilities will have most of their requirements hedged already but if the weather is mild or generation from wind and solar surprise, a move in either direction is possible as we head into year-end. Thin markets mean that speculative positioning as well as any remaining hedging into year-end will have a disproportionate effect on the market. The further we get through the week the more likely we are to see range-bound trading and subdued trade volumes. The weather looks mild for the next week so overall, we maintain a neutral view for the week.

OTHER NEWS

EU parliament extends EU ETS exemption for non-EU flights

The European Parliament has revised legislation to extend the exemption of all non-EU flights from the EU ETS until 31st December, 2023. The extension of the ‘stop-the-clock’ legislation will “allow the experience necessary for the implementation of the UN International Civil Aviation Organisation (ICAO) scheme to be gathered”. Intra-EU and EEA flights will continue to be covered in the meantime. CORSIA, the ICAO run scheme, will look to impose a global carbon offsetting scheme upon international aviators from 2021 onwards. However, doubts over the ambition of the scheme have been raised and the EU will monitor the rules and regulations. The parliament also agreed to bring the aviation cap reduction in line with that of the rest of the EU ETS. The aviation sector will now face a Linear Reduction Factor of 2.2% from 1st January, 2021. And EUAAs (that can only be used by aircraft operators) will also be abolished from 2021, everyone will use EUAs in Phase IV. A decision on the level of auctioning, initially scheduled to be amended to around 50% (from the current level of 82%) has been put off until 2019.