Market developments

- Carbon leaps 8% to end the week at €5.83

- Power prices in the driving seat as further nuclear outage fears fuel gains

- Another mixed week for the clean dark spreads – Cal 18 makes large gains but Cal 19 & Cal 20 fall

- Swiss ETS link up moves closer

- Higher nuclear generation in Q4 2017 to put pressure on carbon prices

EU Allowance Auction Overview

- Volume up to ~10.8Mt from ~8.9Mt last week

- August auction volume falls to ~44Mt from ~91.5Mt in July

- See auction table below for details

Carbon Forward 2017 Programme has been released, venues announced

LIMITED AVAILABILITY: for installations producing less than 1 million tonnes of CO2 Redshaw Advisors have negotiated rates with up to 70% off! See advert below. Register your interest. This year’s conference will be held at the 5-star Canary Riverside Plaza Hotel in London’s Canary Wharf.

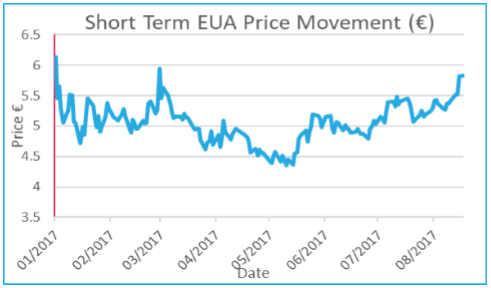

EUA PRICE ACTION

A big week for carbon as prices surged 8% higher to end the week at €5.83. The driving force behind the rise was power prices which moved substantially higher on new fears for a decrease in future nuclear power generation in France. The French nuclear safety authority ASN called for a review of nuclear power plant components manufactured by Creusot Forge. Initial fears of prolonged outages for French nuclear power plants proved to be unfounded but had already driven German and French power prices substantially higher and led to steep rises in the carbon price as €0.30 was added on Wednesday. Choppy trade early on Thursday morning saw carbon hit the high of the week at €5.96 before falling away as auction demand weakened and traders took profit. The rest of the week followed a more conventional August path as trade was more range bound and in line with average volumes.. Elsewhere it was another mixed week for the clean dark spreads as the Calendar 18 spread once again moved higher but the Calendar 19 & 20 both fell as nuclear outage fears impacted the front rather than the back end of the curve. Price Impact: so far it has been a busier August than perhaps expected. Auctions have been strong despite the year-on-year increase in volumes as utilities remain active. The majority of utility reports indicate higher thermal and lower renewable power generation so far this year so the strong carbon prices we are witnessing come as no surprise.

A big week for carbon as prices surged 8% higher to end the week at €5.83. The driving force behind the rise was power prices which moved substantially higher on new fears for a decrease in future nuclear power generation in France. The French nuclear safety authority ASN called for a review of nuclear power plant components manufactured by Creusot Forge. Initial fears of prolonged outages for French nuclear power plants proved to be unfounded but had already driven German and French power prices substantially higher and led to steep rises in the carbon price as €0.30 was added on Wednesday. Choppy trade early on Thursday morning saw carbon hit the high of the week at €5.96 before falling away as auction demand weakened and traders took profit. The rest of the week followed a more conventional August path as trade was more range bound and in line with average volumes.. Elsewhere it was another mixed week for the clean dark spreads as the Calendar 18 spread once again moved higher but the Calendar 19 & 20 both fell as nuclear outage fears impacted the front rather than the back end of the curve. Price Impact: so far it has been a busier August than perhaps expected. Auctions have been strong despite the year-on-year increase in volumes as utilities remain active. The majority of utility reports indicate higher thermal and lower renewable power generation so far this year so the strong carbon prices we are witnessing come as no surprise.

WEEK AHEAD

Auction volumes remain low over five auctions this week and the national holiday next Monday means there are only 4 auctions next week. However, next week also signals the return to full auction volumes as Friday 1st September will see the daily auction volume climb back over 4Mt. The resumption of full auctions could lead to pressure on prices beforehand – last year we witnessed a sell off at the end of August. The same cannot be ruled out again this year, however, much of the recent strength can be attributed to the utilities and it is unlikely they will be phased by the return of the auctions as any short-term requirements are covered regardless. That said, carbon could be due for a correction lower, however, last week has proved the sensitivity of finely balanced power markets across Europe and the impact on carbon prices cannot be underestimated so we go into the week with a neutral view but with a chance of some downside.

OTHER NEWS

Swiss ETS link up moves closer

The link between the EU ETS and the Swiss ETS has moved a step closer as procedural processes advanced with formal ratification from both sides close, possibly before the end of 2017. Progress on the linkage has been slow with the project initiated in 2010, however, the refusal of the Swiss government to remove limits on EU workers free movement to Switzerland had stalled talks. A compromise was found in 2016 and talks have gathered pace since.

The Swiss ETS is dwarfed by the EU ETS with total yearly emissions little more than 5Mt v 1.7Bt in the EU ETS. However, the exercise, if successful, may pave the way for other linkages with larger schemes in the future.

French nuclear availability set to rise in Q4 2017

Nuclear availability in Q4 2017 should rise compared with the same period last year according to the current maintenance schedule of national operator EdF. Average outages through Q4 2016 were 23.2GW, 18.9GW and 13.3GW for October, November and December respectively. However, scheduled maintenance figures for Q4 2017 show an average unavailability of just 7.7GW with October the highest month, averaging 11.7GW. Nuclear safety fears surfaced in Q4 2016 and led to large-scale unscheduled shutdowns causing carbon prices to spike as thermal generation was forced to cover the shortfall, a situation that has been repeated through much of 2017 and helped support carbon prices. The scheduled return of nuclear generation through Q4 2017 will put pressure on carbon prices at a time when auction volumes are more than 60Mt higher year-on-year.

Carbon Forward is back and Redshaw Advisors announced as official partner

The EU ETS is changing and those with most at risk, industry and aircraft operators, are in most need of understanding the impacts of the changes. The Carbon Forward 2017 conference will, with the help of a line-up of expert speakers, examine the issues affecting companies with exposure to the EU Emissions Trading System (ETS) and provide some answers. The conference will focus on:

- Brexit – the effect on EUA prices and UK emitters

- Carbon price rises – how the Market Stability Reserve changes everything

- Free allocation – how the Phase IV (2021-2030) review impacts your bottom line

- Advice – how to maximise free allocation and receive grants for new technology

EU ETS emitters are already expected to foot the bill for Europe’s flagship emissions reduction programme so to help reduce the financial burden Redshaw Advisors have negotiated special discounts for you. .

Interested in attending or finding out more? Fill in your details here and you will receive regular updates on the latest speaker announcements, program developments and special offers. More information can also be found at www.carbon-forward.com.

Alternatively, if there is something you would really like to see in the conference program please drop us an email with your suggestion(s) and we will let you know what we can do to make it happen.