Market developments:

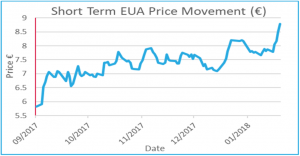

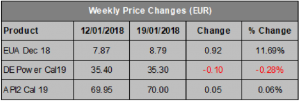

- Carbon ends the week at €8.79, an unexpected gain of more than 92c.

- Carbon rises to levels not seen for five years, hitting €8.85.

- Gains run counter to bearish fundamentals

- Clean Dark Spread losses continue with profit margins halved since the start of 2018.

- UK auction timetable released.

- The Daily Market update is back for those looking to purchase allowances for year-end compliance requirements.To receive it please click here.

- Redshaw Advisors Group Training Day – let us know if you are interested. See page 3 for more information.

EU Allowance Auction Overview:

- Auction volume falls to ~17Mt this week, down from ~20.5Mt

- January brings a total of ~66.5Mt to market

- See auction timetable below

EUA PRICE ACTION

Carbon rose to levels not seen for five-years last week as EUA prices hit €8.85. The gains continued despite the continuation of largely bearish fundamentals and an additional auction. The sharp increases now mean carbon has risen 7.5% so far this year, despite a sell-off in the first week of 2018. The most logical explanation for the gains falls at the feet of speculators as compliance buyers, who have budgeted for much lower carbon prices, are largely waiting it out mainly while verification takes place but also in the hope of lower prices. Utilities are also likely to be

Carbon rose to levels not seen for five-years last week as EUA prices hit €8.85. The gains continued despite the continuation of largely bearish fundamentals and an additional auction. The sharp increases now mean carbon has risen 7.5% so far this year, despite a sell-off in the first week of 2018. The most logical explanation for the gains falls at the feet of speculators as compliance buyers, who have budgeted for much lower carbon prices, are largely waiting it out mainly while verification takes place but also in the hope of lower prices. Utilities are also likely to be  taking a backseat as the coal-fired power generation returns have now fallen by more than 50% in 2018 as power prices continue to struggle while coal and carbon continue to gain. Having closed just above €8 on Tuesday further gains appeared to be in store thus causing any shorts to close out positions. Going into the year it was tempting to be short EUAs as often January heralds a downwards correction. The shorts would have been holding out for the price impact of last week’s additional auction on Wednesday. However, EUAs were well-bid and the shorts all headed for the exit at the same time and caused the price to jump. Wednesday’s auction registered the highest volume of bids so far in 2018. Thursday saw a record day of options trading on the largest exchange, the ICE (42.5Mt), which gave the underlying market another shot in the arm. The majority of the options traded were call options, presumably bought by companies speculating that the prospect of the MSR will boost prices towards year-end. The buyers will have wanted price exposure and the sellers would have needed to delta hedge. The upshot was that there was more EUA buying interest as a consequence. As the price rose this would have been self-reinforcing (i.e. the call sellers would have had to buy more EUAs to cover their exposure). Carbon added 31c on Thursday and another 30c on Friday to close the week at €8.79. A most unexpected (and unforecastable) outcome! Price Impact: the size of the gains amidst a bearish short and mid-term outlook has taken participants by surprise. Gains may be overdone.

taking a backseat as the coal-fired power generation returns have now fallen by more than 50% in 2018 as power prices continue to struggle while coal and carbon continue to gain. Having closed just above €8 on Tuesday further gains appeared to be in store thus causing any shorts to close out positions. Going into the year it was tempting to be short EUAs as often January heralds a downwards correction. The shorts would have been holding out for the price impact of last week’s additional auction on Wednesday. However, EUAs were well-bid and the shorts all headed for the exit at the same time and caused the price to jump. Wednesday’s auction registered the highest volume of bids so far in 2018. Thursday saw a record day of options trading on the largest exchange, the ICE (42.5Mt), which gave the underlying market another shot in the arm. The majority of the options traded were call options, presumably bought by companies speculating that the prospect of the MSR will boost prices towards year-end. The buyers will have wanted price exposure and the sellers would have needed to delta hedge. The upshot was that there was more EUA buying interest as a consequence. As the price rose this would have been self-reinforcing (i.e. the call sellers would have had to buy more EUAs to cover their exposure). Carbon added 31c on Thursday and another 30c on Friday to close the week at €8.79. A most unexpected (and unforecastable) outcome! Price Impact: the size of the gains amidst a bearish short and mid-term outlook has taken participants by surprise. Gains may be overdone.

WEEK AHEAD

With the gains attributed to speculators the market ‘feels’ over-bought. Big trading orders are impossible to predict, especially when going against underlying price drivers. Typically, speculators will eventually sell whatever they buy and therefore, a correction cannot be ruled out. However, some of the buying was short close-outs and with the MSR now less than a year away it is likely that a good part of the speculative interest at present is with one eye on the longer term. One less auction this week should provide support for current levels and if a correction occurs it is likely to run into worried compliance buyers who will snap up carbon at lower prices. Overall, thanks to low CDS and mild weather we favour some kind of correction, but it is a low auction week and it is impossible to rule out further gains if speculators re-take the driving seat.

OTHER NEWS

UK 2018 auction timetable released

The 2018 UK auction timetable has been released following delays due to the Brexit amendment. The UK delayed the release until the conclusion of the political wrangling that threatened the functioning of the market at the back end of 2017. The UK will auction a total of 101Mt in 2018 via the ICE platform in fortnightly sales beginning on 7th February.

Bulgaria joins forces with Poland in EU lawsit

Bulgaria has joined forces with Poland in a lawsuit against new emission limits for large thermal power plants. The Industrial Emissions Directive (IED) will impose new limits on sulphur oxides (SOx), nitrogen oxides (NOx) and mercury emissions and could, if adhered to, lead to large scale coal-fired power generation shutdowns in both Poland and Bulgaria with the majority of existing generation unable to meet the limits. Poland and Bulgaria argue the IED is based on ‘wrong and unrepresentative data’ as well as lodging objections based on procedures.

2030 renewables target agreed by EU Parliament

The EU Parliament has voted in favour of a new target aimed at achieving a 35% share of renewable energy in the EU by 2030. The EU Commission had put forward a 27% target but parliament chose to back the target proposed by the Industry and Energy Committee last year. Trilogue talks will now aim to find agreement between parliament, Member States and the EU Commission. This could undermine EUA prices and temper longer-term price forecasts.