Market developments:

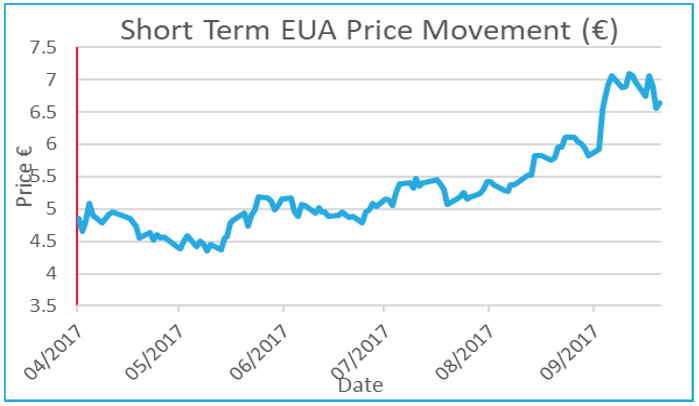

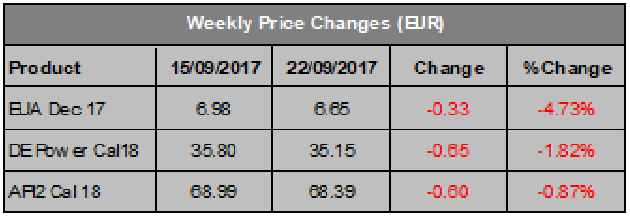

- Carbon falls nearly 5% to end the week at €6.65

- Another volatile week with a €0.73 trading range

- Clean dark spreads give back much of the previous week’s gains

- UK seek transitional Brexit period to reduce risk of hard EU ETS exit

- German election weakens Markel’s hand

EU Allowance Auction Overview:

- Volume falls to ~22.1Mt, down from ~22.6Mt last week

- Auction supply will remain high in October as ~91.5Mt comes to market, slightly down on September’s ~91.8Mt

- See auction table below for details

BREXIT, Phase IV, Analyst showdown, Paris Agreement, Internal Carbon Pricing …and much more. LAST CHANCE TO RESERVE YOUR PLACE: As you can read in the last few weeks of our carbon market update there’s a lot going on in carbon markets. Get up to speed at September’s Carbon Forward 2017 conference, download the programme here. This year’s conference will be held at the 5-star Canary Riverside Plaza Hotel in London’s Canary Wharf.

EUA PRICE ACTION

Another volatile week for carbon as prices tumbled nearly 5% to end the week at €6.65. The weekly trading range was again high at €0.73 as large moves in power, coal and gas prices added to the high supply from auctions and weighed heavily on carbon. We went into the week cautiously bearish as prices looked unsustainably high given carbon fundamentals and so it turned out. However, carbon continued to take direction from power prices. A power price rally early in the week was mirrored by carbon before both fell substantially on Thursday. Carbon plummeted to an intra-day low of €6.47 and only manged a small recovery into the close. The rally earlier in the week was caused by news of an extended investigation by the French nuclear safety authority ASN after irregularities were found in 12 reactors. Last week’s price action further highlights that carbon is hostage to power price moves. The clean dark spreads also suffered as 8-12% was wiped off the longer dated generation spreads, denting the incentive for utilities to hedge however the spreads remain near year to date highs. Price Impact: the availability of nuclear generation in France has the market very nervous and any further developments in this story are likely to substantially, and rapidly, influence the carbon market. Until the nuclear situation is resolved it would appear carbon market volatility will remain high.

Another volatile week for carbon as prices tumbled nearly 5% to end the week at €6.65. The weekly trading range was again high at €0.73 as large moves in power, coal and gas prices added to the high supply from auctions and weighed heavily on carbon. We went into the week cautiously bearish as prices looked unsustainably high given carbon fundamentals and so it turned out. However, carbon continued to take direction from power prices. A power price rally early in the week was mirrored by carbon before both fell substantially on Thursday. Carbon plummeted to an intra-day low of €6.47 and only manged a small recovery into the close. The rally earlier in the week was caused by news of an extended investigation by the French nuclear safety authority ASN after irregularities were found in 12 reactors. Last week’s price action further highlights that carbon is hostage to power price moves. The clean dark spreads also suffered as 8-12% was wiped off the longer dated generation spreads, denting the incentive for utilities to hedge however the spreads remain near year to date highs. Price Impact: the availability of nuclear generation in France has the market very nervous and any further developments in this story are likely to substantially, and rapidly, influence the carbon market. Until the nuclear situation is resolved it would appear carbon market volatility will remain high.

WEEK AHEAD

Little change in auction supply this week as ~22.1Mt comes to market which means, overall, the picture for

Little change in auction supply this week as ~22.1Mt comes to market which means, overall, the picture for

carbon is very similar to last week. Future nuclear generation availability in France remains very much in the spotlight. That availability is set to increase over the course of Q4 2017 which should put downward pressure on carbon prices, however, the forecasts and maintenance schedules look shaky as the issue continues to rumble on. Carbon has been on the current upward trajectory since May and last week’s fall in prices is not enough to signal an end to the trend. With the generation spreads still high and the nuclear situation on-going, material price falls are unlikely this week. Longer-term, we expect there is room for some further softening in prices over Q4 2017 so remain cautiously bearish with a very watchful eye on power markets and France.

OTHER NEWS

UK seeks transitional deal that may reduce likelihood of hard ‘Brexit’ from EU ETS

In her latest Brexit speech, British Prime Minister Theresa May has called for a 2-year Brexit transitional period out to 2021 to try and avoid a ‘hard’ Brexit scenario in 2019. The transitional period would see the UK retain current access and obligations to the rest of the European Union for an extended period, increasing the likelihood of an orderly exit from the EU (and, if that is the ultimate decision, from the EU ETS). May reaffirmed the UK’s desire to exit the single market and customs union and rejected the idea of joining the European Economic Area (EEA) or European Free Trade Agreement (EFTA) that allow countries such as Norway a trade connection with Europe without all the obligations.

The plan would need to be approved by EU lawmakers who have been critical of the UK’s uncoordinated and slow progress with Brexit talks to date. The rejection of EEA or EFTA membership also closes two avenues for continued direct participation in the EU ETS however linkage remains a very real possibility.

The progress of Brexit talks is crucial to short and medium-term price forecasts in the EU ETS and the indecision increases the price risk for all European installations. The Carbon Forward 2017 conference, taking place this week in London, will bring together regulators, experts and analysts to explore the potential outcomes. Tickets are still available, reserve your place now.

Merkel remains in charge in Germany but weakened by election results

As expected, German Chancellor Angela Merkel won a fourth term in Sunday’s German election, however, the fall of the current Grand Coalition partner, the SPD, means they will assume the role of official opposition and a new coalition must be formed, a process that is predicted to take several months.

Merkel’s party won 33.2% of the vote share and according to experts could now seek a coalition with the FDP and the Greens. If the Greens are to be involved in the coalition there could be some strengthening on climate policy, however, their viewpoint will clash with the FDP who promised to weaken climate policy if elected….