Market developments:

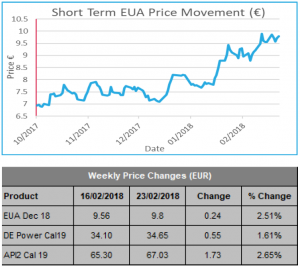

- Carbon ends the week 2.5% higher at €9.80

- Trading takes place within previous week’s range

- Few clues provided for short-term price direction

- Clean Dark Spreads reverse recent gains and fall back to year-to-date lows

- Brexit throws up 2019 compliance conundrum

- Further cap reductions may be proposed by the EU

- The Daily Market update is back for those needing to purchase allowances for year-end compliance requirements. To receive it please click here.

EU Allowance Auction Overview:

- Auction volume falls slightly to 20.5Mt, down from 21.6Mt last week

- Return of UK auctions brings Feb auction total up to 84.3Mt (Jan 66.5Mt, Mar 88.5Mt)

- See auction timetable below

EUA PRICE ACTION

Carbon failed to establish a clear direction last week as EUAs spent time in both positive and negative territory but they remained within the previous week’s trading range. The failure to break out of the €9.37-€10.02 range set the previous week and subdued trading and auction bid volumes indicated indecision in the market. The week began with large gains but ultimately the move higher ran into resistance as the weak underlying fundamental picture buoyed sellers who stood firm and stopped prices hitting a new 2018 high. The gains are likely attributable to the below average temperatures increasing electricity utility demand and some limited buying interest from once-a-year compliance buyers ahead of the 30th April surrender deadline. The fundamental picture deteriorated throughout the week as power price gains were outstripped by coal and carbon gains to leave the clean dark spreads at levels down near the year-to-date lows. Price Impact: carbon currently sits in no-man’s land. Moves in either

Carbon failed to establish a clear direction last week as EUAs spent time in both positive and negative territory but they remained within the previous week’s trading range. The failure to break out of the €9.37-€10.02 range set the previous week and subdued trading and auction bid volumes indicated indecision in the market. The week began with large gains but ultimately the move higher ran into resistance as the weak underlying fundamental picture buoyed sellers who stood firm and stopped prices hitting a new 2018 high. The gains are likely attributable to the below average temperatures increasing electricity utility demand and some limited buying interest from once-a-year compliance buyers ahead of the 30th April surrender deadline. The fundamental picture deteriorated throughout the week as power price gains were outstripped by coal and carbon gains to leave the clean dark spreads at levels down near the year-to-date lows. Price Impact: carbon currently sits in no-man’s land. Moves in either

direction are possible in the coming week…

WEEK AHEAD

Last week’s consolidation provides few clues to the short-term price direction, the outlook for this week remains broadly similar to last week. Below average temperatures and compliance buying should ensure buy-side support, weaker longer-term fundamentals, some limited selling of recently distributed free allocations and no more surprises left in store from short-term weather have the opposite effect. However, carbon has been strong through 2018 to-date despite the worsening fundamentals and the gains witnessed over the last 8 months have been made in a regular pattern: carbon consolidates following moves higher with a small retracement before further gains are made. Will the same pattern repeat itself again? It is to know but it most certainly shouldn’t be ruled out. Overall, we favour the below-average temperatures and compliance buying keeping carbon steady this week. A close below the previous low at €9.37 is required to trigger a larger fall. Although further consolidation seems the most likely outcome at present, recent carbon price moves have been large and swift. If you are in need of allowances for compliance and want to pick the best market entry point, sign up to our daily market updates if you haven’t already.

OTHER NEWS

Brexit throws up 2019 compliance conundrum

To manage the UK’s exit from the EU in March 2019, UK Regulations came into force on 27 December 2017

bringing forward the deadline in the UK for reporting 2018 emissions to 11 March 2019 and the deadline for

surrendering allowances to 15 March 2019. Because of agreed changes to Commission Regulation No.

389/2013, it is possible that 2019 UK allowances will either be identified with a country code or suspended

from being issued to UK operators/aircraft operators. As usefully highlighted by the UK Environment Agency

this means that installations may not be able to surrender allowances issued in 2019 to cover 2018

emissions (i.e. borrowing may not be permitted), and should bear this in mind when planning how to

meet 2018 surrender obligations.

To discuss the implications for your installation and how to manage this risk, please get in contact with the

Redshaw Advisors team on +44 (0) 203 637 1055.

Further cap reductions may be proposed by the EU

The European Commission has stressed it will examine whether to set a steeper EU ETS cap reduction as

part of a future review of post-2020 reforms. The Commission said more ambition would be needed to ensure

the linear reduction factor (LRF) is aligned with the EU’s 2050 emission goals and the UN Paris Agreement.

The statement increases the likelihood that companies covered by the scheme will face tighter emission limits

than those foreseen under current post-2020 ETS reforms. During the reform’s legislative process, the

Commission informed lawmakers that ETS emissions would need to be 90% below 2005 levels by 2050 to be

consistent with the executive’s non-binding 2050 low-carbon roadmap.