Market developments:

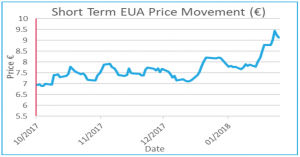

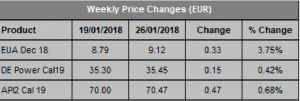

- Further gains for carbon as the week closes at €9.12, a 33c gain

- Intra-week price hits 6-year high at €9.56

- Fundamentals continue to deteriorate

- Clean Dark Spreads slip further

- France to close all coal-fired generation

- UK power sector emissions fall in January

- The Daily Market update is back for those looking to purchase allowances for year-end compliance requirements. To receive it please click here.

- Redshaw Advisors Group Training Day – let us know if you are interested. See page 3 for more information.

EU Allowance Auction Overview:

- Auction volume back up to ~20.5 Mt this week, up from ~17Mt

- Return of UK auctions brings February auction total up to ~84.2Mt

- See auction timetable below

EUA PRICE ACTION

Carbon prices continued to spiral higher last week, hitting an intra-week 6-year high at €9.56. Prices tailed off as the weekend approached to close at €9.12 but still gained nearly 4% over the week. The week began with weakness as prices fell throughout Monday morning, hitting a low of €8.55. However, carbon soon found support and closed Monday just 1c lower at €8.78. Tuesday and Wednesday were virtually one-way traffic as prices moved materially higher throughout the day. The €9.56 high on Wednesday represented a €1 gain from the low in just 2

Carbon prices continued to spiral higher last week, hitting an intra-week 6-year high at €9.56. Prices tailed off as the weekend approached to close at €9.12 but still gained nearly 4% over the week. The week began with weakness as prices fell throughout Monday morning, hitting a low of €8.55. However, carbon soon found support and closed Monday just 1c lower at €8.78. Tuesday and Wednesday were virtually one-way traffic as prices moved materially higher throughout the day. The €9.56 high on Wednesday represented a €1 gain from the low in just 2  days. The nature of the buying, coupled with the deteriorating fundamental picture would suggest it was speculators driving the gains. Our understanding is that, amongst others, there are funds building large positions in EUAs to take advantage of the price strength expected later this year in relation to the MSR start date of 1st January 2019. Unfortunately, quantifying the amount of interest that is additional to natural supply and demand is impossible. Our expectation on Wednesday was that prices rises would not continue indefinitely because the carbon market analyst’s reports, presumably followed by the speculators, suggest that EUA prices were, at their height, above most forecasts for 2018. The nature of the price rises also suggests that some came from short positions that were forced to close out. Prices slid on Thursday and Friday as the frenzied buying appeared to ease and the market seemed to be reverting to trading based on fundamentals. With the return to five auctions a week for the foreseeable future, continued mild weather, plentiful renewable supply, good nuclear availability and tumbling clean dark spreads there is not much upside from the fundamentals, aside from once a year compliance buying. Price Impact: After a decent volume was sucked up by non-natural carbon buying interests last week it may take several weeks or even months for supply and demand to get back to some kind of balance and interact normally, in particular as once-per-year compliance buyers will enter the fray over the coming few weeks. It is hard to know at this stage if prices will move materially lower before the compliance deadline.

days. The nature of the buying, coupled with the deteriorating fundamental picture would suggest it was speculators driving the gains. Our understanding is that, amongst others, there are funds building large positions in EUAs to take advantage of the price strength expected later this year in relation to the MSR start date of 1st January 2019. Unfortunately, quantifying the amount of interest that is additional to natural supply and demand is impossible. Our expectation on Wednesday was that prices rises would not continue indefinitely because the carbon market analyst’s reports, presumably followed by the speculators, suggest that EUA prices were, at their height, above most forecasts for 2018. The nature of the price rises also suggests that some came from short positions that were forced to close out. Prices slid on Thursday and Friday as the frenzied buying appeared to ease and the market seemed to be reverting to trading based on fundamentals. With the return to five auctions a week for the foreseeable future, continued mild weather, plentiful renewable supply, good nuclear availability and tumbling clean dark spreads there is not much upside from the fundamentals, aside from once a year compliance buying. Price Impact: After a decent volume was sucked up by non-natural carbon buying interests last week it may take several weeks or even months for supply and demand to get back to some kind of balance and interact normally, in particular as once-per-year compliance buyers will enter the fray over the coming few weeks. It is hard to know at this stage if prices will move materially lower before the compliance deadline.

WEEK AHEAD

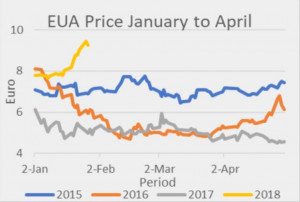

Making predictions in this environment is tough. The January to April price chart shows there is no pattern to the ‘compliance season’ and this year’s extraordinary gains make it even harder to call price direction in the coming week. It all hinges on the speculative buying, if that continues through this week then prices will continue to move higher. Price forecasts of €40 by 2020 from some (non-specialist) analysts certainly pours fuel on the fire. However, prices above or near most analysts’ forecasts for the whole of 2018 could put the brakes on additional gains from the speculative section of the market, for now. If we revert to trading based on fundamentals we would expect to see prices come off. We understand most of the speculative buying responsible for recent gains is with a view on the long term, limiting the chance of a sizeable correction. Any shorter-term speculative selling from the usual market players could lead to a correction of sorts, especially considering the fundamental picture and option delta hedging. However, moves lower are likely to run into compliance buying interest so there will be pockets of support. All in all, with five auctions and poor fundamentals we favour some softening in prices, but this prediction comes with a big caveat that we don’t know how much appetite the wider speculative community has and how much this may tip the balance of short term supply and demand!

Making predictions in this environment is tough. The January to April price chart shows there is no pattern to the ‘compliance season’ and this year’s extraordinary gains make it even harder to call price direction in the coming week. It all hinges on the speculative buying, if that continues through this week then prices will continue to move higher. Price forecasts of €40 by 2020 from some (non-specialist) analysts certainly pours fuel on the fire. However, prices above or near most analysts’ forecasts for the whole of 2018 could put the brakes on additional gains from the speculative section of the market, for now. If we revert to trading based on fundamentals we would expect to see prices come off. We understand most of the speculative buying responsible for recent gains is with a view on the long term, limiting the chance of a sizeable correction. Any shorter-term speculative selling from the usual market players could lead to a correction of sorts, especially considering the fundamental picture and option delta hedging. However, moves lower are likely to run into compliance buying interest so there will be pockets of support. All in all, with five auctions and poor fundamentals we favour some softening in prices, but this prediction comes with a big caveat that we don’t know how much appetite the wider speculative community has and how much this may tip the balance of short term supply and demand!

OTHER NEWS

France to close all coal-fired generation

Emmanuel Macron announced in a speech at Davos that he wanted to “make France a model in the fight against climate change,” closing all coal fired power generation by 2021. This is one of five pillars in his plans to reform the economy. France is not a major coal fired generator but such a move, if it comes to pass, will nonetheless reduce emissions. Across the European Union, the economic tide is already turning against coal power. More than half of the bloc’s 619 coal-powered plants are losing money. A combination of rapidly falling prices for renewables and air pollution laws are pushing them out of business. President Macron also called for the EU, which has the world’s first carbon trading market, to “go a little bit further and create a floor price for CO2.”

UK power sector emissions set to fall in January

Figures for UK power sector generation this month suggest a significant fall in emissions intensity compared to the same month last year. This January has so far seen the average fall to 240g CO2/kWh, down from 339g CO2/kWh. Weaker demand, plentiful renewable supply and warmer temperatures have limited the requirement for coal fired power generation.