Market developments:

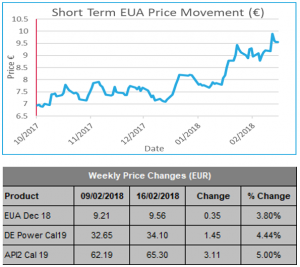

- Carbon ends the week 4% higher at €9.56

- Having rejected lower prices the previous week, carbon saw big gains early week

- Prices hit €10.02 on Wednesday as gains spiralled

- Clean Dark Spreads move slightly higher as power price gains beat coal and carbon gains

- EU considers redirecting EU ETS funds

- Vattenfall wants steeper EU ETS allowance cut

- The Daily Market update is back for those needing to purchase allowances for year-end compliance requirements. To receive it please click here.

EU Allowance Auction Overview:

- Auction volume back up to 21.6Mt from 20.5Mt last week

- Return of UK auctions brings Feb auction total up to 84.3Mt (Jan 66.5Mt, Mar 88.5Mt)

- See auction timetable below

EUA PRICE ACTION

Carbon ended the week 4% higher at €9.56 having made a dash all the way up to €10.02 intra-week. The seismic shift came in the first 2 days of the week as 69c was added to the price to bring EUAs to within touching distance of €10. Almost inevitably Wednesday morning saw that level breached (just) with a trade at €10.02, representing a €1.05 increase from Monday’s low. We were bullish last week because lower prices were rejected but we didn’t foresee such a strong move. Strong auctions at the start of the week suggests that compliance buyers are in the mix but most of the gains are put down to speculative, commodity trend-following, interest. €10 is a big psychological level and carbon ran into selling interest as the more experienced carbon traders sensed a selling opportunity. Wednesday closed at €9.61, suggesting further weakness was in store but for the remainder of the week prices moved largely sideways having tried and failed to move both lower and higher. In related markets power prices moved substantially higher but after coal and carbon rallied there was only a small improvement in the clean dark spread: not enough to cause such a large EUA price rally. Price Impact: carbon moved out the recent range with a bang, however the reversion towards €9.50 by the end of the week would suggest there was some other factor behind the rapid price rises on Monday and Tuesday. The inability to correct lower suggests the short-term demand has not gone away.

Carbon ended the week 4% higher at €9.56 having made a dash all the way up to €10.02 intra-week. The seismic shift came in the first 2 days of the week as 69c was added to the price to bring EUAs to within touching distance of €10. Almost inevitably Wednesday morning saw that level breached (just) with a trade at €10.02, representing a €1.05 increase from Monday’s low. We were bullish last week because lower prices were rejected but we didn’t foresee such a strong move. Strong auctions at the start of the week suggests that compliance buyers are in the mix but most of the gains are put down to speculative, commodity trend-following, interest. €10 is a big psychological level and carbon ran into selling interest as the more experienced carbon traders sensed a selling opportunity. Wednesday closed at €9.61, suggesting further weakness was in store but for the remainder of the week prices moved largely sideways having tried and failed to move both lower and higher. In related markets power prices moved substantially higher but after coal and carbon rallied there was only a small improvement in the clean dark spread: not enough to cause such a large EUA price rally. Price Impact: carbon moved out the recent range with a bang, however the reversion towards €9.50 by the end of the week would suggest there was some other factor behind the rapid price rises on Monday and Tuesday. The inability to correct lower suggests the short-term demand has not gone away.

WEEK AHEAD

Unfortunately for once-a-year compliance buyers the fundamentals don’t point to a material correction lower in the short-term. That carbon could not continue to move lower at the end of last week would suggest buyers are happy to take advantage of any correction and therefore dips may continue to be short-lived. The distribution of free allocation towards the end of February might help the supply situation but we don’t expect a flood of selling interest. Carbon has been happy to ignore the fundamentals in 2018 so the outlook for the week ahead is the same as last week: prices will remain supported by winter weather and compliance buying. The €10.02 level is a new target that the bulls will try to overcome. Material gains above this level seem unlikely but the market is sensitive to the upside at the moment and once-a-year compliance buying interest is picking up so it is difficult to call exactly how far the bulls could take the price.

OTHER NEWS

EU considers redirecting ETS funds.

EU leaders will discuss this week whether revenues from the EU Emissions Trading Scheme (EU ETS) should be fed into the EU budget after 2020, rather than allocated to individual Member States. The move could help shore up EU funding following the UK’s EU exit, which could result in a revenue gap of up to €13bn/yr, the commissioner for budget and human resources said. Redirecting EU ETS proceeds into a central EU pot could add €7bn to €105bn in revenues to the EU budget over seven years, depending on the price of EUAs. EU ETS revenues are currently fed back to Member States, who can choose whether their allocated revenues are assigned to joint EU programmes or added to domestic budgets.

Vattenfall wants steeper ETS allowance cut.

The annual rate at which emissions allowances are withdrawn from the EU’s Emissions Trading Scheme (EU ETS) must be accelerated even further if the aims of the Paris climate agreement are to be met, Vattenfall said. The European Parliament last week approved a series of post-2020 reforms for the EU ETS, which included plans to increase the linear reduction factor (LRF) for allowances, the amount cut each year from the scheme, to 2.2% per year from 2021 (an increase on the current 1.74% rate). Raising the LRF is key to the EU meeting its 2030 target of reducing greenhouse gas emissions by 40% from 1990 levels. Vattenfall say that if the aims of the 2016 Paris agreement are to be met, the annual cut in the allowance cap should be at least 2.6%.

Unsurprisingly, EdF’s CO2 emissions rise in 2017.

EdF emitted around 50.5Mt CO2 last year, a rise of around 6% year-on-year from the 47.7 Mt CO2 emitted in 2016. The increase was mainly driven by rises in carbon emissions in both France and the UK. The firm’s French power generation and supply arm emitted more CO2 due to French gas and coal-fired units producing more power to cover shortfalls in supply owing to technical issues at some French nuclear plants and low hydropower stocks (France had its driest year since 2011 last year). EdF’s emissions are not the whole story, other electricity utilities will also have increased their emissions to help make up the nuclear and hydro shortfall and are likely to have caused a large part of the price rises we saw last autumn.