Market developments:

- Carbon ends the year hitting fresh highs

- Recent gains only supported by auction suspension, other fundamentals paint a different picture

- Clean dark spread front year returns suffer but longer dated returns hold steady

- Expedited 2018 compliance and verification dates become UK law

- Transition period support increases likelihood of extended UK EU ETS participation

EU Allowance Auction Overview:

- Auctions resume on 8th January, 2018

EUA PRICE ACTION

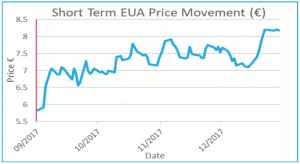

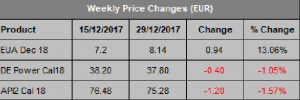

In a repeat of trading at the end of 2016, carbon prices climbed aggressively over the Christmas holiday period as auction curbs left the market short. The high of the year (€8.30) traded on the 22nd December. Although prices eased a little into the final close of 2017, ending the year at €8.14, EUA price still experienced a ~24% gain in 2017 and a massive 90% increase from the low back in May. Fundamental price drivers, other than curbed auction supply, did not support the price rises as mild windy weather, higher nuclear availability, little or no utility/industrial

In a repeat of trading at the end of 2016, carbon prices climbed aggressively over the Christmas holiday period as auction curbs left the market short. The high of the year (€8.30) traded on the 22nd December. Although prices eased a little into the final close of 2017, ending the year at €8.14, EUA price still experienced a ~24% gain in 2017 and a massive 90% increase from the low back in May. Fundamental price drivers, other than curbed auction supply, did not support the price rises as mild windy weather, higher nuclear availability, little or no utility/industrial  hedging and falling gas prices combined. Just as last year, that saw prices rise by around €1.50 in the days before Christmas, the gains in carbon are only explainable by larger speculators playing with a thin market, possibly trying to artificially boost their trading book profits at year-end. The gains in carbon prices also put pressure on the clean dark spreads, however, a strengthening EUR/USD rate helped limit the falls by neutralising coal gains. Price Impact: year-end, thin markets are more difficult to call and the divergence from the fundamental price drivers suggest carbon was artificially boosted and could well be in for a negatively biased bumpy ride in the coming week….

hedging and falling gas prices combined. Just as last year, that saw prices rise by around €1.50 in the days before Christmas, the gains in carbon are only explainable by larger speculators playing with a thin market, possibly trying to artificially boost their trading book profits at year-end. The gains in carbon prices also put pressure on the clean dark spreads, however, a strengthening EUR/USD rate helped limit the falls by neutralising coal gains. Price Impact: year-end, thin markets are more difficult to call and the divergence from the fundamental price drivers suggest carbon was artificially boosted and could well be in for a negatively biased bumpy ride in the coming week….

WEEK AHEAD

In early 2017 the market dropped straight back down in the first week of January, before the auctions resumed. The resumption of auctions in January will test the real levels of buying interest, however, with the fortnightly UK auctions not set to resume until early February due to the UK EU ETS law amendment there will be at least one small supportive price driver during January. Should fundamental price drivers remain unsupportive a material price correction could be on the cards. However, if prices can emerge from January unscathed there will be additional support from once-a-year compliance buyers, the number of whom is growing every year. The MSR, now only a year away, will play an increasing part in price development through 2018, however the timing, quantum and impact of pre-emptive speculative buying interest is difficult to quantify. For the week ahead, it will be hard for anything but weakness to prevail. 2018 will likely be a bumpy ride, ultimately ending in price gains.

OTHER NEWS

Expedited 2018 compliance and verification dates enter UK law

UK law has been formally changed to adjust the 2018 verification and compliance dates for UK installations to 11th March, 2019 and 15th March, 2019 respectively. The change affects UK installations only and is part of a measure to avoid 2018 UK issued allowances becoming ineligible in the EU ETS. The law change came into effect on 27th December, 2017. The knock-on effect of the change is a delay to the resumption of UK allowance auctions in 2018. The auctions, hosted on the ICE platform, will not resume until early February pending approval for the calendar from the European Commission. Brexit will bring a number of changes to all EU ETS participants. Join our Brexit Working Group on Linked In to stay on top of developments.

EU support for transition period increases likelihood of UK participation in the EU ETS until the end of Phase III

Broad support for a transition period across the EU has increased the likelihood of UK participation in the EU ETS until the end of Phase III. The EU set out the possible arrangements for a transitional period in negotiating mandates published on 20th December, 2017. However, the transitional period is far from agreed as the EU reaffirmed its stance against the UK ‘cherry picking’ the details of any future trading arrangements. In the transitional period the UK would be subject to EU law in full and from the 29th March, 2019 would have no say in any future law changes.