Market developments:

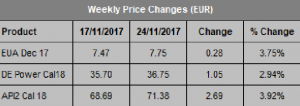

- Indecision reins – carbon ends the week just 7c lower at €7.68

- Tight 37c trading range as conflicting factors leave carbon in ‘no man’s land’

- Wider energy mix provides no impetus for carbon as the clean dark spreads remain little changed over the week

- Brexit clause softened as Member States largely agree with UK counter-proposal

- Poland’s MSR lawsuit looks set to fail after ECJ advisor rejects claim

EU Allowance Auction Overview:

- Auction volume down slightly to ~22.1Mt this week, from 22.6Mt last week

- December auction volumes fall to ~53.5Mt

- See auction timetable below

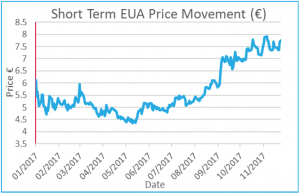

EUA PRICE ACTION

Indecision reined last week as carbon spent most of the week in a relatively tight trading range (37c) without testing recent highs or lows. Much like the previous week, last week’s price action provides few clues on the short-term direction of carbon prices, but another week closer to the auction shutdown further reduces the likelihood of material falls into the year-end. We had a neutral view going into last week based on conflicting price drivers. Colder weather and the Brexit clause vote (see ‘Other News’) largely cancelled each other out and little direction was provided by the wider energy mix as the near dated clean dark spreads

Indecision reined last week as carbon spent most of the week in a relatively tight trading range (37c) without testing recent highs or lows. Much like the previous week, last week’s price action provides few clues on the short-term direction of carbon prices, but another week closer to the auction shutdown further reduces the likelihood of material falls into the year-end. We had a neutral view going into last week based on conflicting price drivers. Colder weather and the Brexit clause vote (see ‘Other News’) largely cancelled each other out and little direction was provided by the wider energy mix as the near dated clean dark spreads  were largely unchanged, only the 2020 spread suffered moderate falls. Generally, prices struggled through the week with the high set on Monday at €7.82 not tested again through the week. Early trade on Friday suggested larger weekly falls might materialise as the low of the week at €7.45 traded before the morning auction. However, a strong auction helped propel prices higher and to return to the comfort of ‘no man’s land’. Price Impact: at present carbon is drifting sideways with neither buyers or sellers managing to gain the upper hand. Buyers emerge as prices head lower, however, there is currently nothing obvious that will push carbon out of the current range. This will not continue indefinitely….

were largely unchanged, only the 2020 spread suffered moderate falls. Generally, prices struggled through the week with the high set on Monday at €7.82 not tested again through the week. Early trade on Friday suggested larger weekly falls might materialise as the low of the week at €7.45 traded before the morning auction. However, a strong auction helped propel prices higher and to return to the comfort of ‘no man’s land’. Price Impact: at present carbon is drifting sideways with neither buyers or sellers managing to gain the upper hand. Buyers emerge as prices head lower, however, there is currently nothing obvious that will push carbon out of the current range. This will not continue indefinitely….

WEEK AHEAD

The outlook is much the same as last week – with just two full weeks of auctions left in 2017 the risk skews a little more to the upside as each day passes. Cold weather forecasts, unreliable nuclear availability and the looming auction shutdown mean any moves lower in the meantime are likely to be small and short lived as buyers emerge, keen to finalise 2017 purchasing requirements ahead of the Christmas holidays. The Christmas period and auction shutdown are likely to feature long periods of thin trading. Seasoned carbon traders got caught out by a price spike last December so to avoid being caught out by the lack of auctions the utilities will likely have been providing some of the support we have seen in recent weeks. If speculators are in on the game then they may be long, ready to take advantage of any price spikes caused by the loss of auction supply. Perversely, these two factors may cause prices to come off in a period of low supply, if the price rises don’t materialise any speculative length will have to be sold. However, with no auction supply coming into the market the current risk bias is to the upside as any hedging that is forced to be done before year-end will have to encourage selling interest somehow. Additionally, speculators may eye the thin markets as a chance to incite some volatility and top up profits before year-end. Overall, we maintain our neutral outlook for the week ahead. Cold weather forecasts are likely to ensure there is enough demand for allowances from the five auctions.

OTHER NEWS

Brexit clause softened as Member States largely agree to UK counter-proposal

After weeks of wrangling the EU finally saw sense and adopted, in large part, the UK’s suggestion to maintain the integrity of the EU ETS in the case that the UK leaves the EU before the 30th April 2019 compliance deadline (that it is currently set to do as Brexit is currently scheduled for 29th March 2019). As part of the proposal Member States have stipulated that to avoid UK EUAs being invalidated from 1st January 2018, UK law must ensure the compliance deadline for 2018 emissions is no later than 15th March, 2019. This is earlier than the UK had proposed (22nd March, 2019) but later than the 1st March, 2019 deadline many Member States, in particular Germany, were pushing for. Assuming the UK brings forward the 2018 compliance deadline via its planned statutory instrument, UK issued allowances from 1st January 2018 will no longer be marked with a country identifier and therefore will be valid for compliance. However, the new regulation will allow the European Commission to “regularly assess whether prohibiting the use of allowances is still necessary”. If the EU Commission deem it necessary, the regulation will allow for allowances to be marked with a country code and become invalid for compliance. As ever, such rushed changes to the system often cause unintended consequences and the unexpected can still happen. Continue to watch this space for Brexit developments.

Poland’s MSR lawsuit looks set to fail after ECJ advisor rejected claim

A lawsuit that was proposed by Poland, to prevent the creation of the Market Stability Reserve (MSR), looks set to fail after a European Court of Justice (ECJ) advisor ruled against their claim. The outcome is in line with carbon analysts’ expectations. A final ruling by the ECJ is expected in the next few months but final rulings are usually in line with opinions made by the advisors.

In filing the lawsuit Poland claimed the MSR will have a significant impact on its choice of energy supply and therefore they should have the right to veto the implementation in a unanimous vote by the Council. However, their arguments were rejected by the ECJ advisors who highlighted a country’s energy choice is not dependent on the EUA price alone and the choice of energy supply remains firmly in the hands of the Polish government rather than the EU. According to Argus Media, a senior Polish diplomat has said they will accept the ECJ ruling.